Banking in Mexico for Tourists

City in Mexico

Banking in Mexico is a frustrating topic. I ran into so many roadblocks when trying to figure out how to access my finances in Mexico. This article is a compilation to make banking in Mexico easy for you. This article discusses which banks will allow a tourist to open an account, how to avoid ATM fees, how to transfer funds, and credit cards with 0 international transaction fees.

Major Banks in Mexico:

- BBVA

- Santander

- Banorte

- Citibanamex

- HSBC

Banking in Mexico: Getting a Bank Account

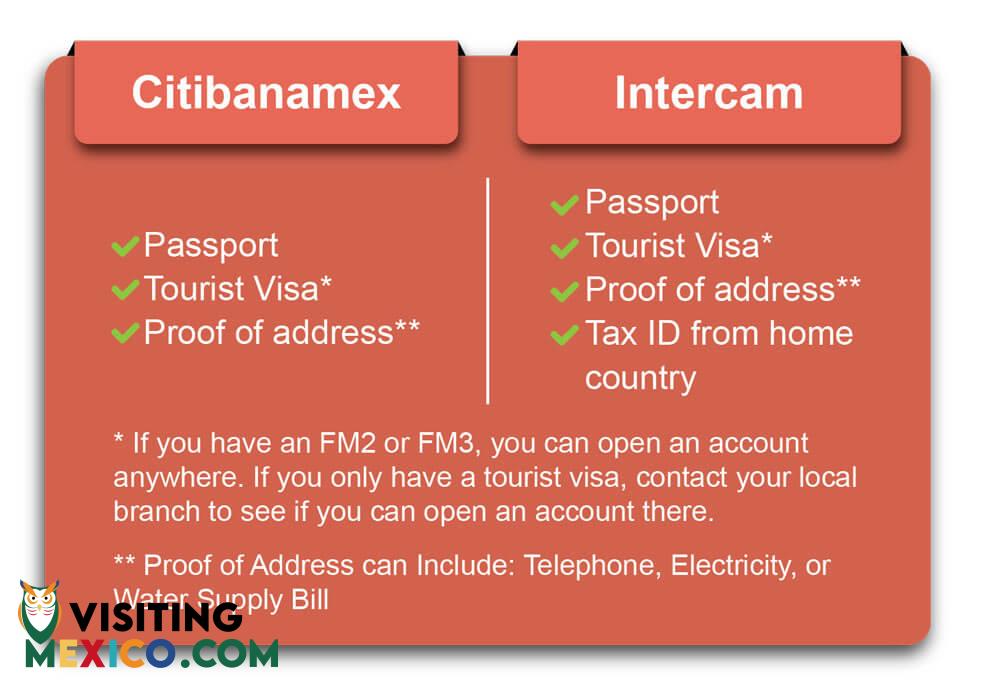

Unfortunately, most banks do not allow tourists or even temporary residents to open bank accounts. However, after some deep digging, I found 2 banks that say they will let a tourist open a bank account: Cibanco and Intercam.

What you need to Open a Bank Account in Mexico:

Requirements for tourists to open a bank account in Mexico

Personal Experince: opening a bank account with an FMM

Getting a bank account might not be a feasible option, because each branch seems to have its own rules. Do not fear, there are some other options to avoid fees and receive money in Mexico.

How to Avoid ATM Bank Fees in Mexico:

ATM fees can add up, so most people try to avoid them. One way is to open an account with a bank in your home country that has a partner bank in Mexico.

-HSBC offers no ATM fees at their Mexican locations.

-Bank of America (partners with Scotiabank) offers no ATM fees at their Mexican locations. However, there is a 3% international fee.

-Scotiabank offers no ATM fees at their Mexican Locations.

-Citibank (Partners with Citibanamex) offers no ATM fees at their Mexcian locations

A Unique Approach:

Charles Schwab, a web-based corporation that offers investment accounts, has no ATM locations meaning they refund all ATM fees worldwide. Even better, they offer no foreign transaction fees.

4 Banking in Mexico for Tourists: Options to Transfer Funds:

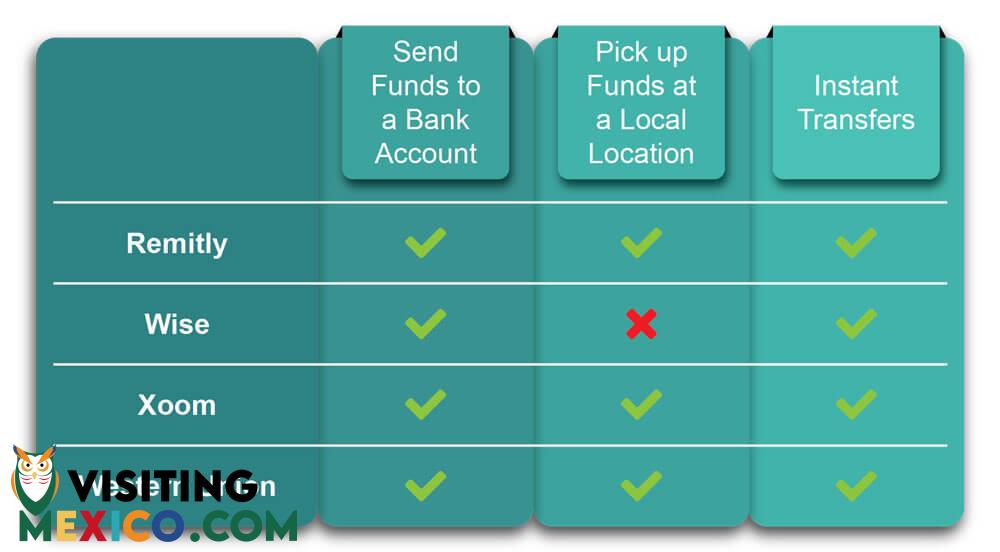

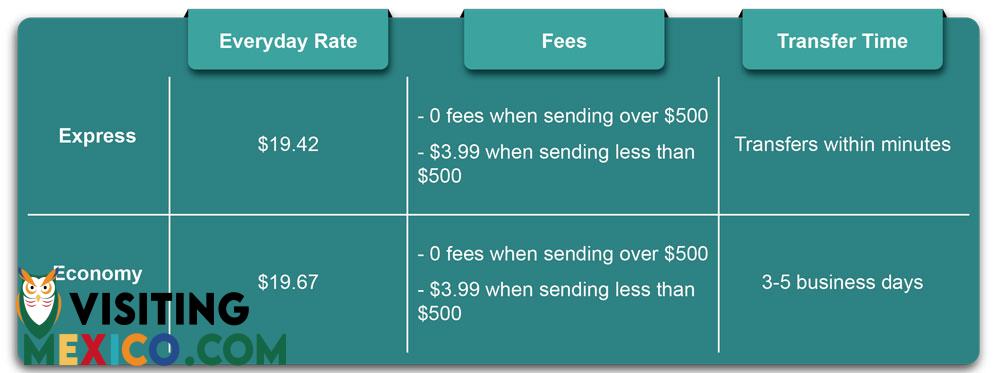

1) Remitly

The great thing about Remitly is that the recipient does NOT need a Remitly account and funds can be sent to a bank account or be picked up at a local partner location.

2) Wise (previously known as TransferWise)

Wise allows funds to be paid with Bank debit, Wire Transfer, Credit Card, or Debit Card.

Funds must be sent to a bank account.

The transfer time varies.

Fees are constantly changing with currencies. However, there is a fixed fee of ($0.64) as well as a variable fee of (1.16%). The exact fees can be found here.

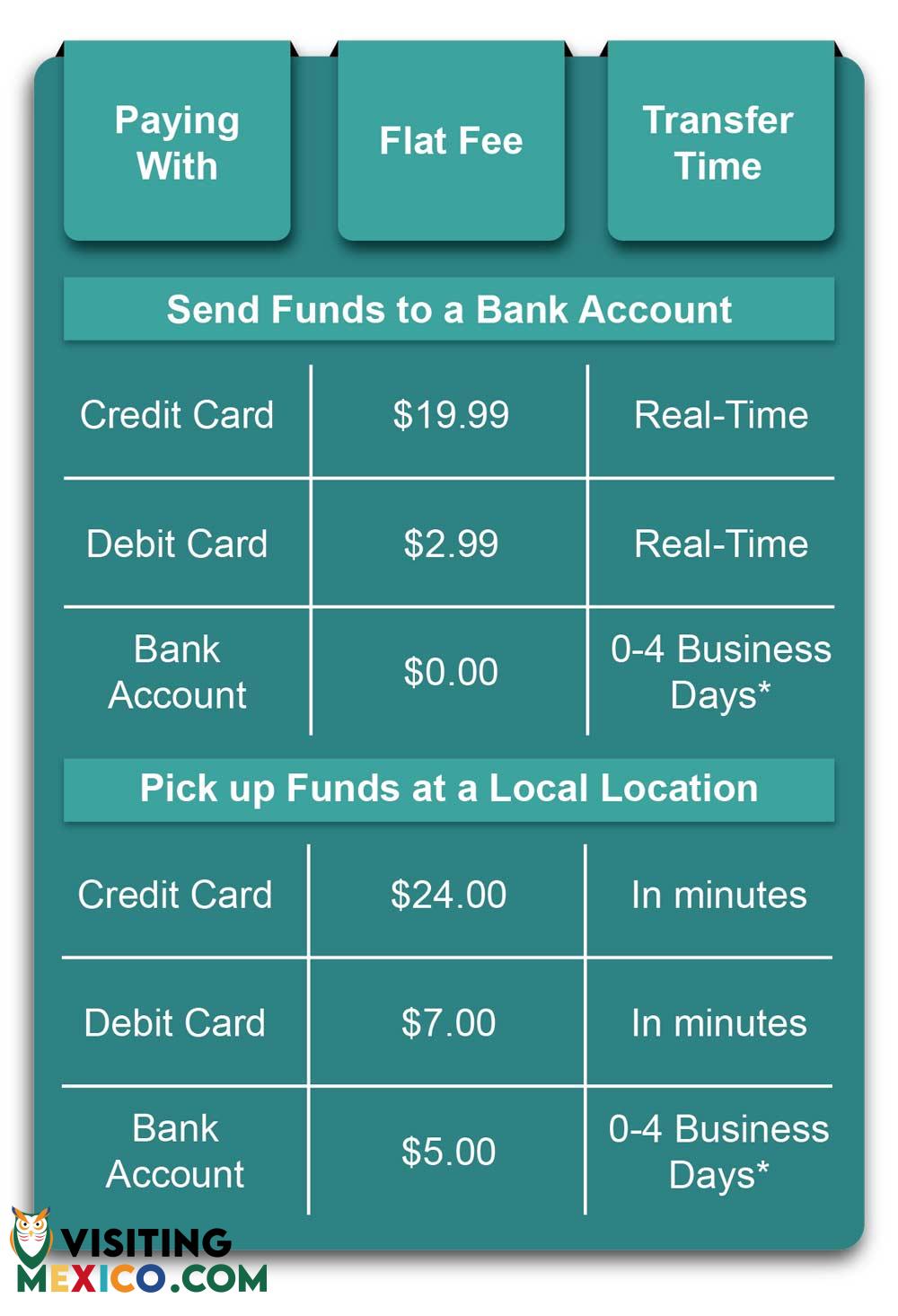

3) Xoom (A Paypal Service)

There is a flat rate of $2.99 when paying with a bank account or PayPal. If paying with a credit card or debit card, the flat rate is $3.99.

Funds can be sent to a bank account or picked up at a partner location (Oxxo, Elektra, BanCoppel, etc..) Pick-up has a $3.99 fee.

Transfer time is within minutes of picking up at a partner location or within hours to major banks in Mexico.

4) Western Union

Western Union is a very popular option because it has lots of locations in the USA as well as Mexico. Funds can be sent to a bank account or picked up at a Western Union partner location. Real-time transfers are available to major banks including Banamex, Bancomer, Santander, Azteca, Bancoppel, HSBC, and Scotiabank. Funds will arrive at all other banks on the same business day if sent before 2:35 EST.

In addition to saving money at the ATM and banks, often credit and debit cards have foreign transaction fees. So be sure to get a credit card with 0 foreign transaction fees.

Top 5 Credit Cards with 0 Transaction Fees:

- Chase Sapphire Preferred-$95 annual fee with 15.99-22.99% APR

- Bank of America Travel Reward Card-$0 annual fee with 13.99-23.99% APR

- Capital One Quicksilver-$0 annual fee with 15.49- 25.49% APR

- Citi Premier-$95 annual fee with 15.99-23.99% APR

- Capital One Venture One- $0 annual fee with 14.49-25.49% APR

There are so many ways that you can avoid unnecessary fees with the right knowledge. When I moved to Mexico, I did not have the right knowledge. By doing some planning before your trip, you can save yourself some headaches and some money. Be sure to look at the city you are visiting to see what ATMs and banks they have to see which options work best for you.

By: Rebekah Mullinix